Blog

Lloyd's Register Energy divestment: Applied Fission

October 15, 2020

Some say that the inauguration of the futuristic HQ extension in Central London was the most exciting thing that happened around Lloyd’s Register in the last 25 years. Even today, the building with its “structural expressionist” style is a tourist sight and hotly debated among architecture aficionados. Maybe it is this unglamorous steadfastness that helped the inventor of ship classification and probably the oldest TIC company of them all survive the wars, political turmoil and numerous economic crises of the last 260 years.

Last week though, LR made headlines again, at least in the world of TIC, when announcing to sell its Energy business to UK midmarket PE firm Inspirit Capital. This not only means that Lloyd’s Register divest around 16% of group revenue (GBP 144m in 2018/19), but also constitutes a noteworthy strategic u-turn, seven years after the acquisition of Senergy.

The decision does not come as a total surprise – especially not to the readers of this blog, a notorious and long-standing proponent of more focus in TIC. When considering that Senergy achieved revenues of GBP 121m at the time of acquisition in 2013, it becomes obvious that the then envisioned growth failed to materialize. It just did not work as planned, and so LR now pull the plug. Rare bold decision-making in an industry fraught with leniency and wishful thinking.

It will be interesting to see what Lloyd’s Register will be able to achieve with the remaining portfolio, essentially now “Marine” and “Certification”. Growth opportunities in the first one look constrained with already pre-Covid limited growth of global fleets, de-globalisation and a petrified competitive landscape. That leaves Certification as the only possible growth avenue – with strong competitors however such as BSI.

From a more general point of view, as LR went from four to just two segments in a mere five years (LR Rail sold to Ricardo plc in 2015): is there still room for something like corporate strategy or is this just a thinly-masked downward spiral?

Beyond Lloyd’s Register, the decision could have a few other interesting ramifications:

- What does that mean for RINA’s new strategy, more or less a Mediterranean adaptation of LR’s blueprint, that was supposed to propel the company to an IPO? Gut feeling: maybe a revision will be necessary…

- If LR are serious about Certification, will this lead to higher competitive pressure in that segment and further consolidation, culminating in an “ISO endgame”?

- Will eventually someone acquire or merge with SAI Global’s Assurance business?

- Or are we going to see further consolidation in the ship classification segment – maybe even a merger of some kind between LR and DNV-GL?

In a broader context, we expect more of that to come – at first sight surprising, but at closer inspection compelling portfolio cleanups in TIC that will open up new opportunities for investors and pave the way for further industry consolidation.

Global Trade: The Spectre of Re-Localisation

March 4, 2020

Even though not really a distant past, it feels difficult to recollect how considerably different global sourcing patterns and manufacturing systems looked only 15 years ago. Take the example of elevators and lifts: Historically this has been and, at least superficially, still today is a “Western” play dominated by OEMs such as Schindler (Switzerland), Kone (Finland), Otis (USA) or ThyssenKrupp (Germany), but the very basis of this industry has shifted more or less completely to China. Western by appearance, Chinese by substance: Experts estimate that today 75% of all parts in the global elevator and lift industry are produced in and around Shanghai, within a radius of 100 kilometers. Most of the global industry’s know-how is now based there, and doing without this cluster seems to be impossible. [1]

In the high-level macroeconomic accounting of trade balances and current accounts, such fundamental transformations deeper down in supply chains do not really show up. But they have happened and somehow fit to the lambasting rhetoric against China’s “unfair trade policies” – albeit not in the way plaintiffs may think. In fact, rather than being a victim of a vile Chinese plot, the “West” and Western companies themselves happily promoted and pushed this arrangement, lured to China by the unique combination of skilled and hard-working labor at highly competitive wages, a huge domestic market, potentially massive Economies of Scale and excellent infrastructure.

Justified or not, the Trump administration drives the so-called “Decoupling” by encouraging a re-shoring of manufacturing from overseas (China) to the United States through a mix of policy instruments: Tariffs, domestic tax reform and technology bans (cp. Huawei). Reg. the latter, the administration has intensified and extended its efforts in the international arena, discouraging the use of Chinese 5G technology whenever and wherever possible.

In addition, it also leverages the ongoing OECD deliberations on revised global tax standards. Initially pushed i.a. by the EU to participate in the huge profits that American internet giants such as Amazon, Google or Facebook extract from Europe with insignificant local tax payments, the U.S. government has successfully pushed for extending the scope to other industries. If successful, the world could move to a tax regime in which the country of consumption or use is entitled to a much larger part of an economic activity’s tax income, e.g. by taxing revenues or through international re-distribution. Clearly, this would disadvantage global manufacturing hubs such as China or Germany. And for companies, this would significantly change the “footprint choice formula”, as producing closer to consumers would certainly become more attractive then. [2]

Another factor is the declining cost advantage of manufacturing offshoring. Automation reduces the importance of labor cost in general, and rising wages in China and other parts of Asia further narrow the cost differential. In consequence, highly-automated “re-shored” production with very small but extremely productive workforces has turned into a viable and competitive alternative to a “globalized” supply chain and manufacturing system that, in comparison, does not yield spectacular cost savings anymore. “Globalization” often might just not be worth the effort these days.

The impact of all that has started materializing in the numbers. According to recent statistics, American imports from China are declining, and so is the number of open job postings in U.S. manufacturing, i.e. employment in U.S. manufacturing grows. “America first” seems to deliver results, and at least this element of “Globalization” is in reverse. (Note: Please see source [2] for the charts)

In this situation of “Globalization” already being under attack, the “Coronavirus” COVID-19 exposes how vulnerable these long and complex supply chains have become in the pursuit of maximum efficiency. In the end, quite logically, a single global manufacturing hub is the most efficient configuration, and as pointed out, in many cases this turned out to be China (by choice or evolution). Now that COVID-19 has effectively brought the Chinese economy to a grinding halt, it becomes evident how critical and massive the dependencies on Chinese inputs have become. Some of them are less serious, such as Coca-Cola running out of sweetener for Coke Zero [3]. Others are grave but not a matter of life and death, such as the supply chains disruptions in the Automotive industry [4]. Some however are dangerous and unreasonable, such as the dependency on Chinese and Indian antibiotics production – a risk pointed to by pharmaceuticals experts already 2-3 years ago and more than just a problem in times of international health crisis. [5]

All this casts a very different light on “Globalization”: economically efficient and nice for corporate profits in the past, but not necessarily going forward – and certainly detrimental to national employment, depriving governments of tax income and not very resilient, but rather very vulnerable in times of crisis. In other words: Neither very sustainable nor politically acceptable anymore for Western electorates.

Evidently, there are good reasons for the emerging trend towards “Re-Localisation”, which is not just the obsession of obscure right-wing politicians. COVID-19 finally shows that more redundancy is sensible and necessary, and such redundancy could also pacify economic woes in countries that heavily exported jobs in the last years. In our opinion, it can be expected that COVID-19 will speed up this development as a catalyst.

Despite being labeled “populist” or “protectionist”, it is not unreasonable to assume that “Re-Localisation” could be an important and potentially the prevalent policy of the 2020s.

What does all this mean for the TIC industry?

“Globalization” of manufacturing and trade has greatly propelled the TIC industry forward, an argument made several times e.g. by Intertek. [6, pages 15 and 16] But how big was the impact really, and what would it mean for the industry to move on without this major supportive force?

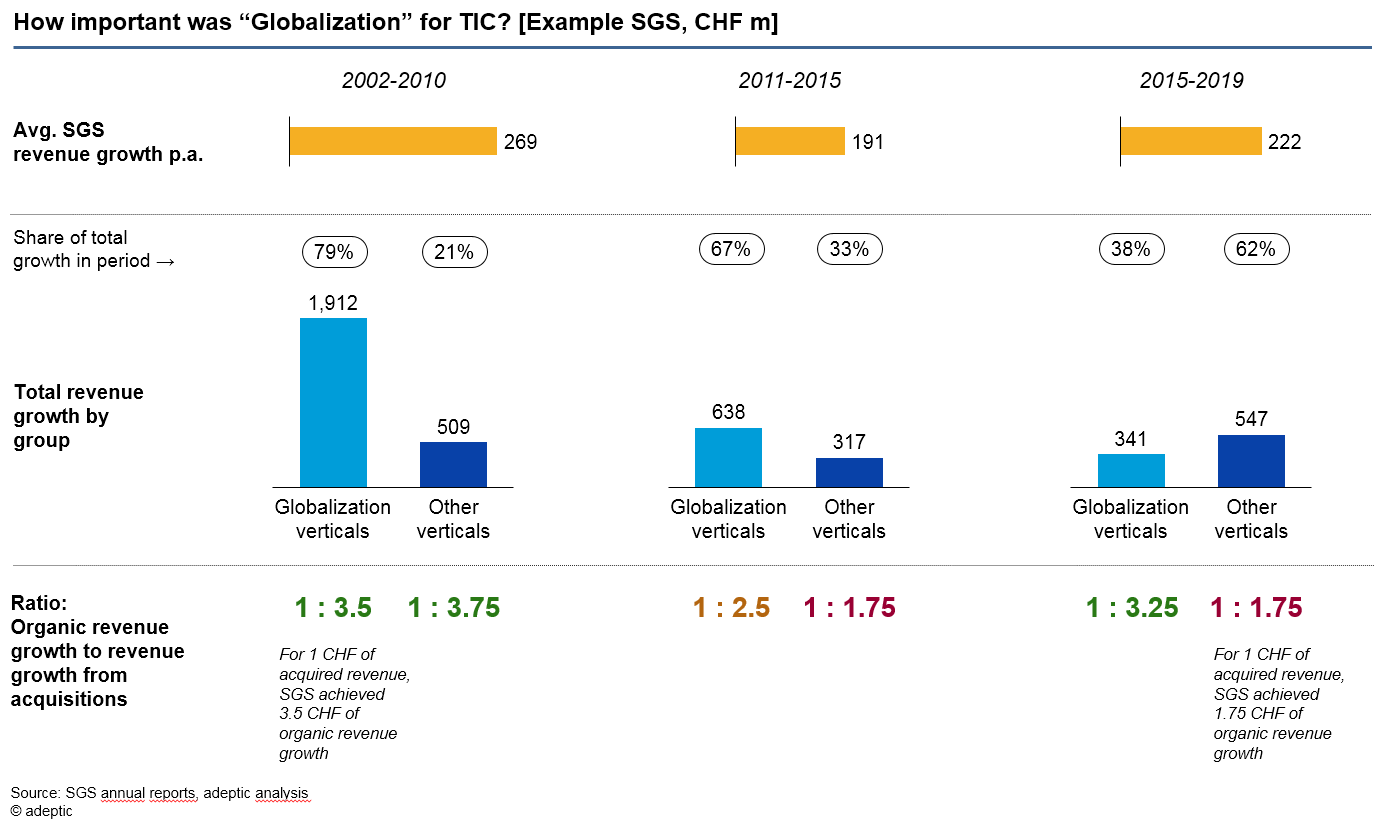

We have therefore analyzed SGS’ growth story and annual results between 2002 and 2019. SGS is not just the TIC industry leader, but also has been remarkably constant in its reporting structure over time, only changing it once in all these years. This allows us to understand growth dynamics without distortions from organizational adjustments. The outcome of our analysis is visualized in the chart below, showing revenue growth over time and the importance of acquisitions for that.

We have grouped SGS’ businesses into two clusters: the “Globalization verticals” (Minerals; Oil, Gas, Chemicals; Consumer Testing; Industrial) and “Others”. The first cluster of segments clearly and greatly benefitted from “Globalization”, due to an increased demand for raw materials, fuel, inputs, the massive offshoring of manufacturing, rapid expansion of industrial output in Emerging Markets and China, the formation of global supply chains and the huge growth of global trade.

Observations:

- Growth in “Globalization verticals” was a key factor for SGS’ rapid overall expansion. We estimate that “Globalization” accounted for roughly a third of overall revenue growth since 2002 (about CHF 1.5bn).

- Interestingly, even in the seemingly drier spell between 2011 and 2015, SGS’ revenue growth was still strongly driven by “Globalization verticals” – speed of expansion had slowed down in these, but was still higher than in the rest of the portfolio.

- In the “New Normal” since 2015 however, SGS has to rely on the “others”, who have taken over the role as primary revenue growth drivers

- “Globalization” not just delivered growth, but organic growth. It did not require a lot of M&A, and still does not. And while the absolute growth contribution of “Globalization verticals” has decreased, the mechanism has stayed the same

- In sharp contrast, it required substantially more M&A to kick off growth in the “other verticals”, and staying on the growth path in these still does. Organic annual revenue growth averaged around CHF 40-45m per “other” segment until 2015

- It appears that SGS has adjusted its M&A policy at some point of time around 2010, investing significantly stronger into the “other verticals” in order to nurture and foster their development

Conclusions:

- For TIC, “Globalization” delivered strong expansion at minimum effort – an age of easy, mostly organic growth. It’s never going to be that easy again

- Growth was stronger in the heyday of “Globalization”, but today’s growth rates still feel reasonable in comparison. The key difference is that attaining similar growth today requires substantially more M&A – costlier and more challenging in execution

- If some of the previous growth and revenue were lost in a potential reversal of “Globalization”, it will be toil and tears instead of picking up replacement revenue effortlessly and easily like in the 2000s. Compensating revenue declines in “Globalization verticals” will require substantially higher efforts and hard work

- Growth in the “Globalization verticals” of course required CAPEX as well, but M&A in TIC is a much more expensive endeavor in comparison. Continued growth in TIC will either require more investment – ultimately questioning the industry’s beloved and praised cashflow-generation and dividend-payout model. Alternatively, if unwilling to commit additional resources to M&A, the industry’s growth rates will remain restricted. It will be interesting to learn which scenario investors and shareholders prefer

Taken together, this analysis raises the question whether the TIC industry’s established value-creation model, which heavily relied on “Globalization”, has already peaked. With “Globalization” in reverse, attaining similar growth rates, or maybe even growing at all, will require considerably higher efforts for business development and a lot more M&A.

However, it might be unwise to flog the idiomatic “dead horse”. Re-Localisation also holds opportunities for TIC: not in the field of product testing, conformity assessment and trade inspections, but e.g. in ensuring consistency across regional production hubs. In any case, “Re-Localisation” will require significant adjustments to strategies.

In this context, pushing harder and harder for optimization of the current setup is still possible, but probably not pareto-efficient. It will yield incrementally lower effects with disproportionately increasing required effort. Metaphorically: With the lemon already quite squashed in the vice, how much additional juice can you still squeeze out?

Beyond that: How much further will having operational go-getters fight for every basis point of margin take this industry? Isn’t it about time for more and better strategic thinking?

The TIC industry is now forced to develop a new growth model, as the old one is coming (or maybe already has come) to its end. It is uncertain though whether the new one will be as powerful as the old one, yielding similar growth rates, or whether the industry might be headed for a phase of stagnation. Unfortunately, the latter cannot be ruled out.

This further underlines the importance of a well-designed strategy these days in TIC. Happy to help you on that.

[2] https://www.nzz.ch/wirtschaft/chinas-coronakrise-spielt-trump-in-die-karten-ld.1540926

[3] https://edition.cnn.com/2020/02/25/business/coca-cola-coronavirus-artificial-sweeteners/index.html

[5] https://www.rolandberger.com/en/Publications/Reliability-of-antibiotics-supply-in-Germany.html

Statutory Vehicle Inspection: Chain reaction

January 13, 2020

Apart from the fireworks, the Champagne and the unavoidable Instagram selfies with “2020” balloons, the turn of the decade seemed to be a relatively unspectacular event. For the European Automotive industry though, Dec 31st 2019 marked the end of an era of glove-on treatment.

From 2020 onwards, the long-looming drastic tightening of the EU’s “fleet CO2 emission targets” became a reality. For those unfamiliar with the topic: In order to fight global warming by reducing CO2 emissions, the EU already in 1995 defined that the average CO2 emissions per kilometer for each car sold must not exceed a certain, gradually decreasing (i.e. more ambitious) target. Both general and company-specific goals were set – the latter to account for the fact that it is much easier for an OEM such as Fiat, who predominantly sells small fuel-efficient cars, to reduce emissions per vehicle than for Mercedes-Benz.

The formula is simple: For each OEM, sum up the generic CO2 emissions per km for each car sold in the EU (as per homologation) in one year and divide by the number of cars sold by this particular OEM, giving an average annual CO2 emission per km per car – the OEM-specific “fleet CO2 emission value”.

For each gram of CO2 above the target, a penalty has to be paid – for each car sold. This penalty increases over the years and is set at EUR 95 per gram excess emissions for 2020. Example: 1 million cars sold in 2020, 1 gram of CO2 emissions on average above the target – EUR 95 million penalty for the respective OEM.

The clear goal is to incentivize OEMs to work towards improving fuel efficiency, propagating electric vehicles and in general selling smaller cars. A cleverly designed policy.

So far, so good – but where is the problem? Well, until Dec 31st 2019 23:59, the EU CO2 fleet target was set at a rather comfortable 130 grams of CO2 emissions per km per car. From Jan 1st 2020 00:00 onwards, the target is 95 grams. A quite significant, and sudden, cut by more than 25%.

It would be wrong to say the industry wasn’t able to prepare, as this was decided and set into motion more than 10 years ago. But still, it didn’t manage – maybe because selling vast numbers of these gasoline-powered SUVs was too much of a temptingly lucrative business, and because car buyers simply love their “Chelsea tractors”.

Now, the Automotive industry is in trouble and faces potentially huge penalties, depending on the 2020 sales mix. A simulation performed by the reputable CAR-Center Automotive Research at the University Duisburg-Essen in 2018, confirmed to be still realistic, concluded that, based on the expected sales mix without a considerable number of battery-electric vehicles and hybrids,

- The BMW Group could face a penalty of EUR 1bn

- Daimler of EUR 1.25bn

- The Volkswagen Group of EUR 4bn and

- even Fiat and PSA of EUR 600-700m.

A painful extra-burden to carry in times of massive required investment into e-mobility.

Interestingly, Automotive OEMs seem to have found a solution, or rather scapegoat, for the problem. According to a recent narrative, it is not their fault to offer the wrong models – it is the fault of car dealers to sell the wrong cars, leading to an unfortunate sales mix. Consequently, dealerships would have to carry (most) of the penalties.

That would bring most car dealers to brink of bankruptcy, and most probably push them over the edge – if they do not come up with other sources of revenue for paying the bill. And this is where the TIC industry comes into play.

The 2010s have seen at least one legislative initiative in the EU parliament towards the so-called “Meister-HU” / “Repairshop Vehicle Inspection”, i.e. further liberalization of Statutory Vehicle Inpection. There are pro’s for and con’s against that, which have been debated at length. In any case, until now, the TIC industry was able to defend 3rd party Statutory Vehicle Inspection, one of its most profitable segments.

But this time, it could be different, due to the potential sheer economic horror in the Automotive industry. To get a feeling for the numbers: The estimated 40,000 Western European car dealerships employ 600,000+ people. Let a third of these go out of business, and 200,000 jobs are lost, too.

We calculate that the five TIC players with the heaviest Automotive SVI exposure (Applus+, DEKRA and the TÜVs) achieve revenues of more than EUR 2bn in the field, extracting profits between EUR 400 and 500m. Factoring in other providers’ revenues and profit, the Western European SVI profit pool is probably worth EUR 500-700m.

Tapping this honeypot would not solve, but alleviate the problem and help transforming an uncontrolled car dealership bloodbath into a more-or-less controlled scale-down. Therefore, with mounting economic pressure, we expect the next push towards SVI liberalization very soon – probably in the 2nd half of 2020, and with much higher chances of success.

In our opinion, yet again, the TIC industry must come to terms with new and deteriorating circumstances: Neither is it immune to unfortunate developments in underlying verticals – nor does its alluring profitability go unnoticed. And potentially, in times of dire straits, its clients may not perceive TIC providers as partners, but their business as prey.